According to the latest report, in the third quarter of 2021, US shipments of desktops, laptops, tablets, and workstations were 30.3 million units, a year-on-year decrease of 16%.

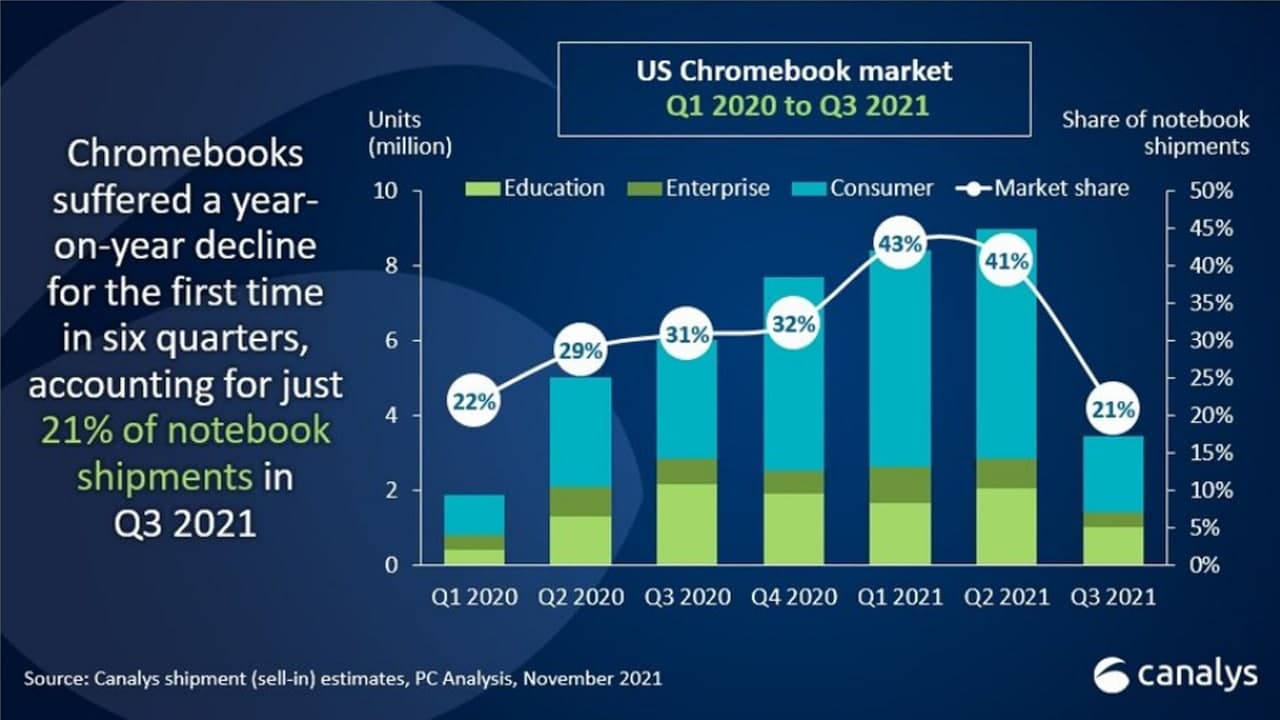

Among them, notebook computer shipments fell 15% year-on-year to 17.1 million units, mainly because the saturation of the education market led to a sharp decline in Chromebook demand.

In addition, due to weaker consumer demand, tablet shipments fell by 24% to 10 million units. Relatively speaking, the desktop market performed best, with shipments increasing 6% to 3.2 million units.

In this regard, Canalys analyst Brian Lynch said: “After achieving double-digit growth for several consecutive quarters, the US PC market has slowed down.” Nonetheless, it is similar to the level before the new crown pandemic. In comparison, overall shipments are still high.

The main reason for the decline was the saturation of demand in the education and consumer sectors, which led to a sharp drop in Chromebook and tablet shipments. At present, the demand brought about by the new crown pandemic has rapidly diminished, and consumers are looking forward to attractive offers during the holiday season.

Join Tip3X on Telegram

Dell ranked first in the US PC market in the third quarter, with shipments increasing 10% year-on-year to 5.6 million units. Although other suppliers have suffered varying degrees of decline, Dell has been able to achieve growth by virtue of its strength in commercial customers.

At the same time, as the largest Chromebook supplier, HP suffered a sharp decline in the third quarter, with shipments plummeting 31%.

In addition, Lenovo’s shipments remained stable, increasing by 3% year-on-year to 3.52 million units. As market demand for M1 MacBooks stabilized, Apple’s shipments fell by 14%. Over-reliance on the consumer market has caused Acer’s shipments to drop by more than 30%.

Moreover, tablet shipments in the United States fell by more than 23% in the third quarter due to the decline in demand to support increased screen access, basic computing, and connectivity. Due to the iPad’s dominance in the US market, Apple holds the top spot with a 45% market share.

Although Amazon’s tablet shipments fell by 41%, it still ranks second. Because its low-cost Android models are still popular in the children and gift market. Samsung had the smallest decline among the top five suppliers, with shipments falling 3% to 1.9 million units. Microsoft and Lenovo ranked fourth and fifth, and both saw a double-digit drop in shipments.

In subdivisions, the education market fell 11% year-on-year and 53% month-on-month. Most school districts in the United States allocate computers to students at a 1:1 ratio. This has led to a decline in Chromebook sales, especially because most of the sales of this model come from the education segment.

With the surge in education purchases in the second quarter, Chromebooks accounted for 41% of all laptop shipments but dropped to only 21% in the third quarter. But the demand for Chromebooks will pick up in the short term. Because the ECF has approved $7.2 billion in education funds, some of the funds will be used to purchase educational equipment.

With the surge in education purchases in the second quarter, Chromebooks accounted for 41% of all laptop shipments but dropped to only 21% in the third quarter. But the demand for Chromebooks will pick up in the short term. Because the ECF has approved $7.2 billion in education funds, some of the funds will be used to purchase educational equipment.

Overall, business computers were the most resilient in the third quarter, maintaining a level similar to a year ago, but the decline in demand in the consumer and education sectors will temporarily slow down the US PC market.

Lynch said, “Despite the negative growth in the first quarter since the new crown pandemic, the outlook for the US PC market is still very optimistic.” The general upgrade of equipment will be conducive to the continued success of the market.